per capita tax definition

The GROSS NATIONAL PRODUCT national income of a country divided by the size of its POPULATION. A poll tax also known as head tax or capitation is a tax levied as a fixed sum on every liable individual typically every adult without reference to income or resources.

Chapter 6 Implementing A Medium Term Revenue Strategy In Realizing Indonesia S Economic Potential

It is calculated by dividing the areas total income by its total population.

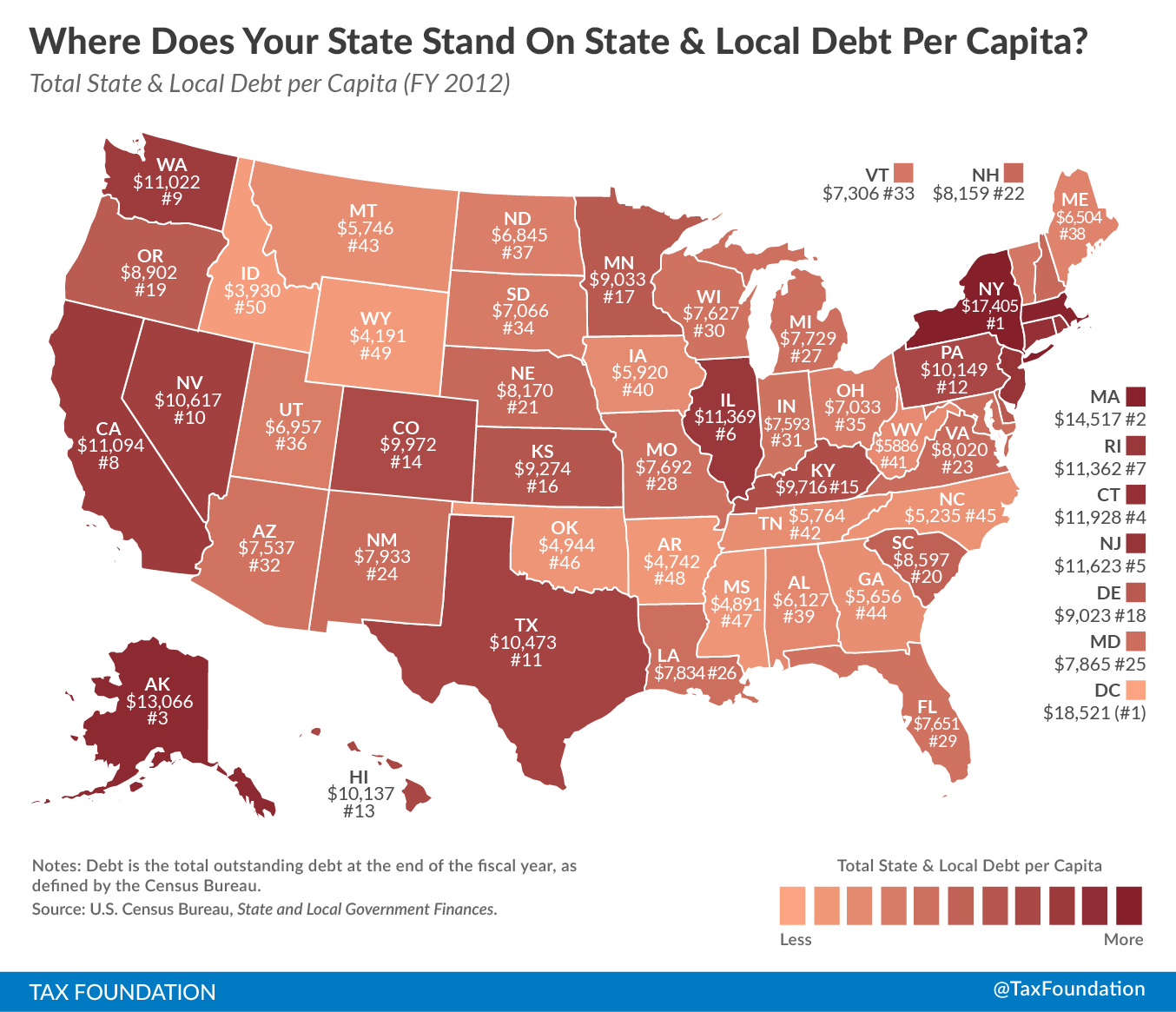

. The highest state and local property tax collections per capita are found in the District of Columbia 3740 followed by New Jersey 3378 New Hampshire 3362 Connecticut 3107 New York 3025 and. Per unit of population. Normally the Per Capita tax is NOT.

Most developing countries by contrast had a per capita. What is the Per Capita Tax. This gives the average income per head of population if it were all shared out equally.

I did not receive my per capita tax bill. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Presbyterians have used per capitaan annual per member apportionment assessed by the general assembly book of order g-30106.

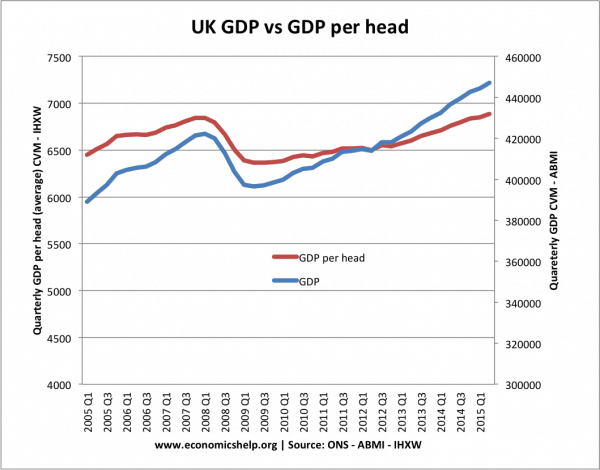

Do I pay this tax if I rent. Per capita helps economists compare GDP figures by accounting for large differences in population. A share wont be created for the deceased beneficiary and all the other beneficiaries shares will be increased accordingly if one of the identified group is deceased.

Used primarily in economics PCI utilizes average income to calculate and present the standard of living. Can you provide me with my invoice number so that I can make a payment online. This ratio can be used to compare and contextualize measurements per person and can provide different information depending on how its used.

Whether you rent or own if you reside within a taxing district you are liable to pay this tax to the district. The school district as well as the township or borough in which you reside may levy a per capita tax. Head taxes were important sources of revenue for many governments from ancient times until the 19th century.

Sample 1 Based on 4 documents Examples of Per Capita Payment in a sentence. For most areas adult is defined as 18 years of age and older though in some areas the minimum age may differ. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction.

Can I have a copy sent to me. The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. In 2003 the UK had a per capita level of 24230 Japan 33990 and the USA 34870.

Per capita is the legal term for one of the ways that assets being transferred by your will can be distributed to the beneficiaries of your estate. It is not dependent upon employment. I lost my bill.

It means to share and share alike according to the number of individuals. For most areas adult is defined as 18 years of age or older. Under a per capita distribution each person named as beneficiary receives an equal share.

On average state and local governments collected 1164 per capita in individual income. Per capita is Latin for by head 3 All the living members of the identified group will receive an equal share if the beneficiaries are to share in a distribution per capita. Can I request a correction.

Per Capita Latin By the heads or polls A term used in the Descent and Distribution of the estate of one who dies without a will. In a per capita distribution an equal share of an estate is given to each heir all of whom stand in equal degree of relationship from a decedent. My billaccount information is incorrect eg addresslast name.

Per capita income is national income divided by population size. I moved and no longer live in this area. By or for each individual a high per capita tax burden.

Tennessees tax on investment incomeknown as the Hall taxis being phased out and will be fully repealed by tax year 2021. Seven states do not levy an individual income tax. Is this tax withheld by my employer.

See also standing rule f4b and by many synods and presbyteries to enable presbyterians mutually and equitably to share the ecclesiastical and administrative costs of sustaining our witness to christas a sign of. In the United Kingdom poll taxes were levied by the governments of John of Gaunt in the 14th. Per capita is a measurement that helps compare different nations statistics on a per person basis.

Alaska Florida Nevada South Dakota Texas Washington and Wyoming. Per capita income is often used to measure a sectors average income and compare the wealth. Per capita income can be used to determine the average per-person income for an area and to.

Standard of Living The standard of living is a term used to describe the level of income necessities luxury and other. In other words if you. A Per Capita tax is a flat rate tax equally levied on all adult residents within a taxing district.

Per capita income is a measure of the amount of money earned per person in a nation or geographic region. Per Capita means by head so this tax is commonly called a head tax. Per capita is a concept used in economics business and statistics to measure by individuals in a population.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Per capita income PCI or average income is the measurement of average income per person in a specific country city or region within a definitive time period. On average state and local governments collected 1675 per capita in property taxes nationwide in FY 2018 but collections vary widely from state to state.

Per capita income PCI or total income measures the average income earned per person in a given area city region country etc in a specified year. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership. Per Capita Payment means the distribution of money or other thing of value to all members of the Tribe or to identified groups of members which is paid directly from the net revenues of any tribal gaming activity.

Both taxes are due each year and are not duplications. By using per capita economists are able to more accurately compare the size of two nations economies. Can I confirm the balance due for my tax bill.

Property Tax Definition Property Taxes Explained Taxedu

Washington From Affluence To Prosperity Economic Opportunity Institute Economic Opportunity Institute

Tax Reform Complete Knowledge On Tax Reform With Example

Information About Per Capita Taxes York Adams Tax Bureau

Indonesia Gdp Per Capita Ppp Data Chart Theglobaleconomy Com

Sudan Gdp Per Capita Current Dollars Data Chart Theglobaleconomy Com

Real Gdp Per Capita Economics Help

Pdf Tax Policy For Economic Recovery And Growth

Pdf The Impact Of Taxation In The Tourism Industry Dynamic Approach

Environmental Tax Statistics Statistics Explained

Austria Household Income Per Capita 2005 2022 Ceic Data

Where Does Your State Stand On State Local Debt Per Capita Tax Foundation

Property Tax Definition Property Taxes Explained Taxedu

Azerbaijan Gdp Per Capita Current Dollars Data Chart Theglobaleconomy Com

/GettyImages-545863985-e964b845dce944dfb2b94153aab83a7a.jpg)